AI Powered

Learning Experience

for your

Empower individuals and teams to unlock their full potential by providing them the power of our generative AI enabled cutting-edge learning experience platform. Foster a culture of continuous learning in your organization.

Trusted by customers around the world

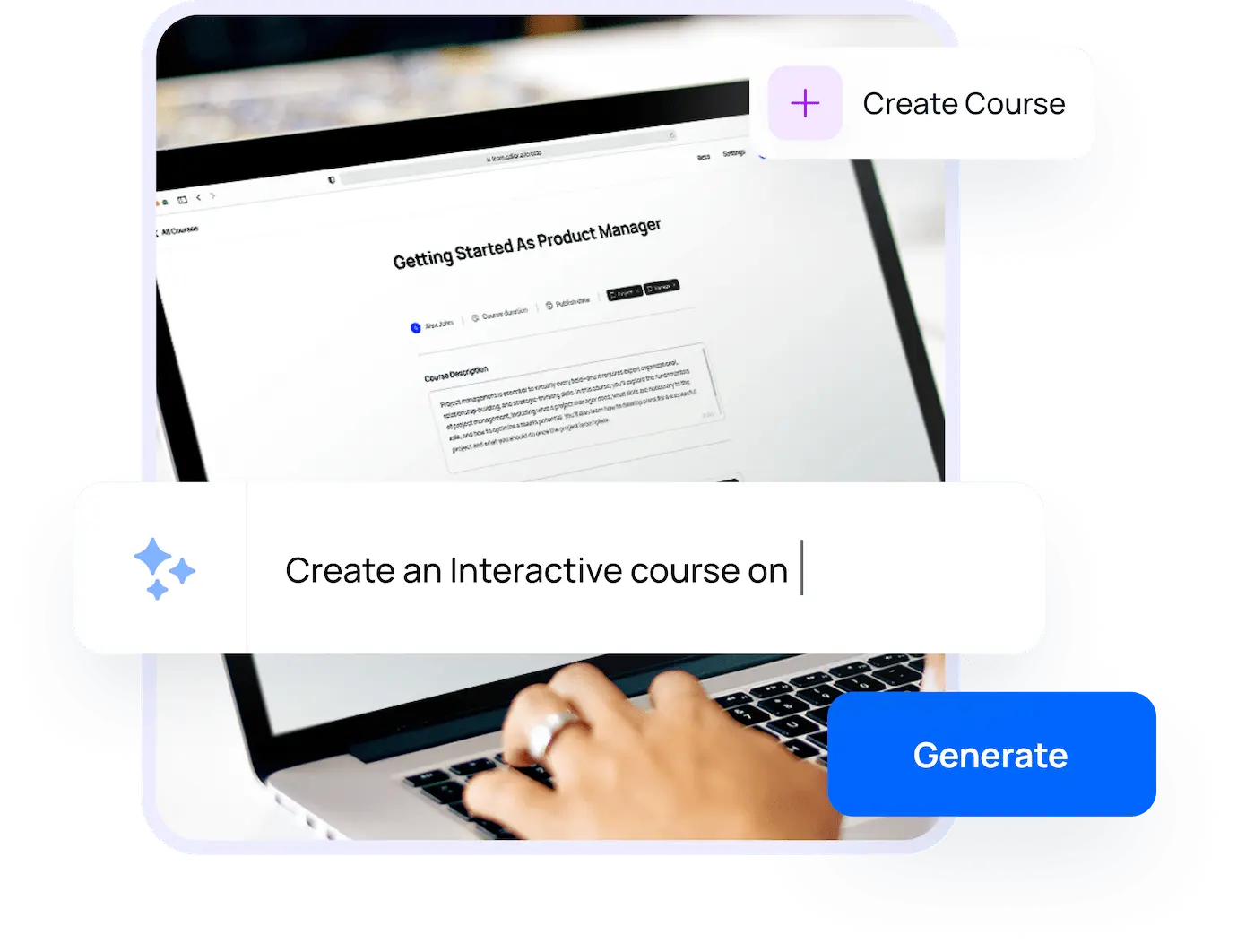

Create engaging courses with generative AI

Create beautiful, engaging micro learning courses in minutes with Calibr’s generative AI powered course authoring tool

Drag-and-drop builder

Use the drag-and-drop builder to drag section headers, lists, images, videos, flash-cards, buttons and rearrange them.

Pre made templates

Use pre made templates, rich-text editor, image library and AI enabled suggestions to build beautiful courses in minutes.

Share knowledge with your co-workers

Facilitate knowledge sharing within your organization by turning your employees into in-house L&D experts.

Build collective knowledge

A single platform to host learning content in multiple formats; micro-learning courses, videos, audio & documents.

Drive-up learning engagement

Drive up the learning engagement through interactive, activity based learning. Make learning fun.

Align learning to your business strategy

Align the learning strategy to the business strategy of your organization through continuous skill assessment.

Skill gap analysis

Continuously measure the skills of your workforce, identify skill gaps, and use the insight to customize learning paths.

360° Analytics

Measure the impact of your learning strategy with detailed analytics across users & groups and maximize the ROI of your L&D investment.

Make learning fun and engaging

A platform built for today's modern distributed workforce. Build a culture of learning in your organization with powerful features like

AI-powered course authoring

Generative AI enabled course authoring tool to create beautiful & engaging courses in-house.

Peer to peer learning

Facilitate knowledge sharing with-in organization. Decentralize the learning process by turning your employees into experts.

Content marketplace

Ready-to-access courses in compliance, leadership, communication skills, technology, and much more.

Multi-format support

Single platform to support learning content in multiple formats; interactive courses, videos, eBooks and documents.

Learning analytics

Measure the effectiveness and ROI of your learning program. Turn the learning data into actionable insights and accelerate learning.

Skill assessment

Get insights into the upskilling needs of your organization before making L&D decisions. Maximize the ROI of your L&D investment.

Mobile learning

Learn on the go with Calibr mobile app; seamless access to learning resources, ensuring engaged learning experiences on any device.

SSO integration

Elevate user experience, streamline access and enhance security with Single Sign-on integration - seamless access and heightened protection.

SCORM support

Experience seamless integration of standardized content delivery with SCORM support. Effortless deployment of SCORM packages.

What our customers have to say about Calibr

Our latest blogs

Stay informed with the latest blogs on LMS, LXP, Learning & Development trends, employee training, instructional design, and upskilling strategies. Dive into expert insights today.

View All